estate tax malaysia

Malaysia residential property sector. This means that in Malaysia there is no final tax on the accumulated wealth of a deceased individual.

Question Of Inheritance Tax Resurfaces In Malaysia The Edge Markets

Exemption orders were released to implement proposals announced under an economic recovery plan in response to the coronavirus COVID-19 pandemic.

. The next RM500000 would be 08 per cent for RM4000. The property held legally by a deceased person at the time of demise is known as deceased persons estate. Duty to notify and posthumous assessments.

Inheritance estate and gift taxes There are no inheritance estate or gift taxes in Malaysia. Rental income is taxed at a flat rate of 24. Shortened as R-P-G-T it is a necessary tax.

It was levied on transfer of property from deceased person to beneficiary. The first RM500000 would be one per cent for RM5000. Sales tax and service tax The rate of both sales tax and service tax is 6.

Net wealthworth taxes There are no net wealthworth taxes in Malaysia. In addition taxes like estate duties annual wealth taxes accumulated earnings tax or federal taxes are not levied in Malaysia. Prior to the abolition of this tax in 1991 estate duty was applicable only if.

The income tax with the highest rate only recently being at 28 has been cut down now to 26 for residents and 27 for non-residents. Record rise in unsold residential units worries Malaysian authorities. No inheritance or gift taxes are levied in Malaysia.

Depreciation does not qualify for tax deductions. 1 deceased 2 Name of deceased persons estate as registered with LHDNM. Those sold less than two years after purchase are subject to ten percent RPGT and those sold between two and five years after purchase are subject to five percent RGPT.

There was an estate duty in place until 1 November 1991 when it was abolished. That means it is payable by the seller of a property when the resale price is. Estate Duty abolished in 1991 Currently Malaysia does not have any form of death tax estate duty or inheritance tax.

Tax rates Pursuant to Schedule 1 a trust is subject to tax at the prevailing fixed rate of 24 of its chargeable income just like a company. Unlike a company though the preferential two-step rates of 17 and 24 for small and medium companies is not available to a trust however small the value of the trust property may be. For context Malaysia used to have inheritance taxestate duty.

If your selling price is RM2 million the calculation is as follows. For the next RM2500000 05. Prior to 1984 estate duties of 12-45 were levied on property with a minimum value of RM100k for deaths in Malaysia 5-60 on property with minimum value of RM40k for deaths outside Malaysia.

Stamp tax real property gains tax exemptions for certain residential property transfers COVID-19 August 3 2020. Malaysias 100 billion Forest City project in trouble as Mahathir hits foreign purchasers. Conclusion In short the probate fees are not subjected to tax.

Real Property Gains Tax. Income-generating expenses are deductible from the gross rent such as interest expense cost of repairs assessment tax quit rent and agents commission. If the gross value of the estate is for only movable property and is less than RM600000 and no person is entitled to apply for Grant of Probate or Letters of Administration one may apply for summary administration via Amanah Raya Berhad section 17 Public Trust Corporation Act 1995.

Real Property Gains Tax There is no capital gains tax in Malaysia. However real property gains tax RPGT applies to properties sold less than five years after purchase. Real Property Gains Tax RPGT Rates Disposal Date And Acquisition Date Disposal Price And Acquisition Price Determination Of Chargeable Gain Allowable Loss EXEMPTION Harga Pelupusan Dianggap Bersamaan Dengan Harga Pemerolehan Available in Malay Language Only Transfer Of Asset Inherited From Deceased Estate.

Then the applications are to be made at the Estate Distribution Unit of the Department of the Director-General of Land Mines JKPTG or Land Office. The remaining RM1 million would be 07 per cent for RM7000. Malaysian property rules discourage foreign buyers.

Nonresidents are taxed at a flat rate of 24 on their Malaysian-sourced income. Inheritance tax in Malaysia was known as estate duty back then. Executor or administrator is required to declare all sources of deceased persons income in the Form TP if the property is not transferred to the beneficiaries.

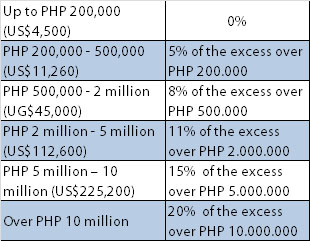

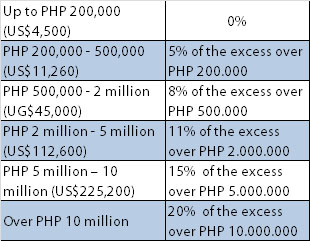

However there are rates chargeable if your assets are worth more than a certain amount in Malaysia. RPGT Act Through The Years 1976 2022 RPGT is a tax on profit. Typically the distribution of assets and money.

Understanding Inheritance And Estate Tax In Asean Asean Business News

Rockwills Estate Planning Can Bring Financial Stability For Your Loved Ones Estate Planning Malaysia Planner

Tax On Rental Income 5 Rules You Must Know If You Rent Out Property In Malaysia

These 21 Sketches Make Complicated Financial Concepts Simple Enough To Fit On A Napkin

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

Understanding The Concept Of Real Property Gains Tax Rpgt Wma Property Understanding Concept Investment Property

Highlights Of Malaysia S Islamic Banking System Http Malaysiafinancialservices Wordpress Com 2013 07 26 What Is Islamic Banking Islamic Bank Banking Humor

These 21 Sketches Make Complicated Financial Concepts Simple Enough To Fit On A Napkin

Cukai Pendapatan How To File Income Tax In Malaysia

1 Nov 2018 Budgeting Inheritance Tax Finance

Real Property Gains Tax Rpgt 2022 In Malaysia How To Calculate It Iproperty Com My

Malaysia My Second Home Program Retire In Malaysia Part 7 Retirepedia Malaysia Retirement Relocation

Chicago Property Taxes Hit Poorest Disproportionately Tax Debt Tax Attorney Tax Accountant

Real Property Gains Tax Rpgt 2022 In Malaysia How To Calculate It Iproperty Com My

Retire In Malaysia What You Need To Know Retirepedia Malaysia Retirement Impossible Dream

These 21 Sketches Make Complicated Financial Concepts Simple Enough To Fit On A Napkin

Where Not To Die In 2022 The Greediest Death Tax States

Understanding Inheritance And Estate Tax In Asean Asean Business News

0 Response to "estate tax malaysia"

Post a Comment